The Bleatings Will Continue Until Morale Improves

adventtr/E+ via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on June 10th, 2022.

With our recent update on BlackRock Science & Technology Trust II (BSTZ), it only seems appropriate to do an update for the sister fund, BlackRock Health Sciences Trust II ( NYSE:BMEZ ). BMEZ is struggling for much the similar reasons that BSTZ is. However, it has a healthcare focus, and the biotech sector has been taking a hit. As the biotech name would suggest, it's an area of technology. Since that means growth, we've seen the fund tumbling. Nobody wants growth investments at this time while rates are rising, especially when the latest inflation number came in hot once again.

That being said, I think that we are looking at a much more attractive price for BMEZ. Combining that with the fund's discount being quite attractive, I think BMEZ is a fair option to consider picking up at these levels. Similar to BSTZ, I'm not sure when a rebound will happen, but it could prove rewarding if you can handle higher risks in the long term. This is a change from my previous update: I liked the fund, but was sticking with a "Hold" rating. I'll be flipping this to a "Buy" rating now. That doesn't mean it will perform well soon, of course. It reflects that I believe there is a greater than 50% chance it will be higher in the next year or two.

The Basics

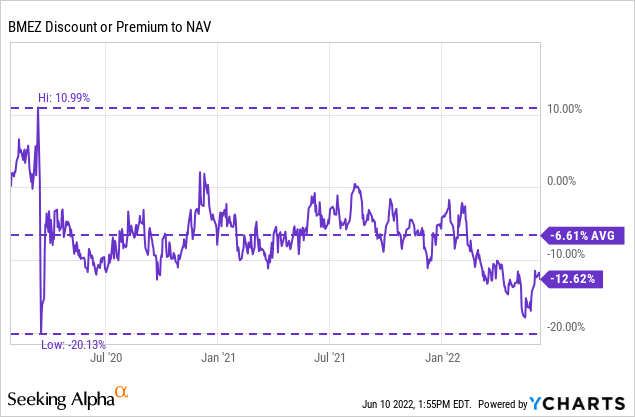

- 1-Year Z-score: -1.25

- Discount: 12.62%

- Distribution Yield: 10.39%

- Expense Ratio: 1.3%

- Leverage: N/A

- Managed Assets: $2.149 billion

- Structure: Term (anticipated liquidation January 29th, 2032)

BMEZ "seeks to invest up to 25% in private companies." It intends to do this through "at least 80% of its total assets in equity securities of companies principally engaged in the health sciences group of industries and equity derivatives with exposure to the health sciences group of industries." With this, it also utilizes an options strategy.

It was last reported that 24.14% of the portfolio was overwritten. This is below its target range of 30% to 40% and would indicate a bullish stance. In hindsight, if they were more aggressive in this strategy, it could have offset a bit more of the losses.

At this point, keeping a lower percentage overwritten seems appropriate, so positions aren't called away during a rebound. Of course, that is whenever such a rebound might happen. It could take a while to get through the pressures of higher interest rates and see through to the other side when inflation starts to cool off.

The fund has a term structure that will see the fund potentially liquidated around Jan. 29, 2032. They may switch to a perpetual fund after a tender offer for 100% of outstanding shares at 100% of NAV. If there are still $200 million in total net assets, the board can convert to a perpetual structure. After that point, there will be no more support to keep the fund to its NAV.

Of course, it isn't realistic to believe there won't be a change in the fund's price and NAV over the next ten years. It's something to continue to monitor and can be taken advantage of closer to the fund's termination date. Ideally, we'd see the NAV and price rise from current levels.

The term structure keeps the fund from trading at a perpetual discount. If the fund performs well, the fund will likely continue to operate. After the fund's launch, it made some significant moves that certainly helped give it a jump start towards that goal.

Performance - Attractive Discount

One interesting note is that BMEZ is now larger than BSTZ. These are both funds of significant size, as BlackRock (BLK) tends to produce large funds. Thanks to their massive size, they have many channels to sell through. This change was the result of BMEZ holding up relatively better than BSTZ. While BMEZ still has private holdings in smaller, more biotech-related companies, they still have some exposure to traditional healthcare too. That seems to have provided a bit of shelter, relatively speaking.

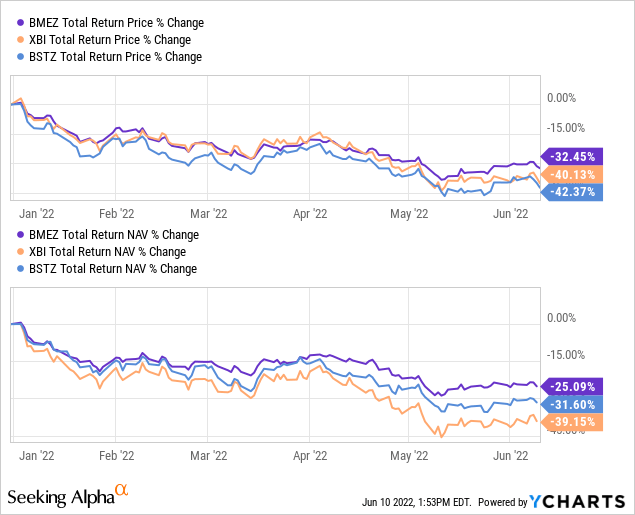

Below we are seeing the YTD results between BMEZ and BSTZ (just for fun, as it isn't comparable) and the SPDR S&P Biotech ETF (XBI). As we can see, BMEZ is holding up significantly better than if it was a pure-play biotech fund. This is to be expected and helps highlight that despite the wreckage we are seeing, it isn't all bad news.

Ycharts

The comparison between the total share price and total NAV return has also produced a widening discount for the year. We aren't exactly at the widest discount yet, but meaningfully below the average discount. It could still be seen as a relatively new fund, so history is rather short.

Ycharts

Distribution - Juicy Yield, But Very Cautious

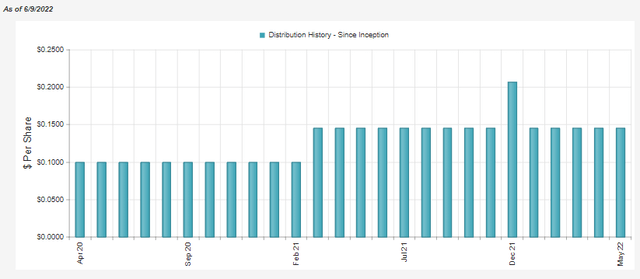

One thing that we mentioned for BSTZ is applicable here too. We noted that BlackRock just made several adjustments to their monthly distributions for CEFs. However, they held BSTZ alone, and they also left BMEZ alone. Yet they got the other sister fund, BlackRock Innovation and Growth Trust (BIGZ).

BlackRock announces distributions every month, so cuts can be announced anytime. However, since they made several adjustments already, I'm leaning towards them holding out for the next quarter to see if there is a rebound.

BMEZ Distribution History (CEFConnect)

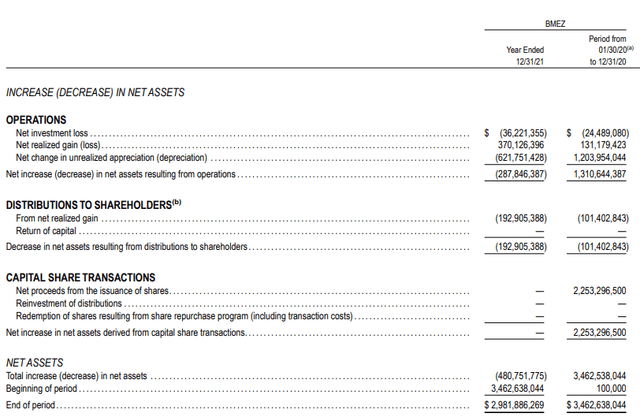

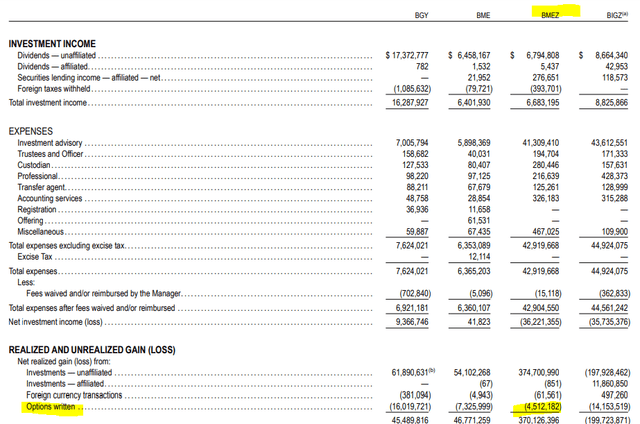

When looking at coverage for BMEZ's distribution, it will come entirely from capital gains. The fund provides no actual net investment income. This is simply because the underlying holdings do not pay sufficient amounts of dividends or interest to offset the earnings. Total investment income came to less than $6.7 million. For a fund that ended 2021 with almost $3 billion in assets, that's certainly not a big driver of the fund. Therefore, we see net investment losses rather than NII.

BMEZ Annual Report (BlackRock)

With their options strategy, they could be generating some gains through that route this year. However, in prior years, this actually resulted in losses for the fund. For fiscal 2021, it wasn't meaningful losses, but they were losses nonetheless. This can result from the fund closing out options positions at a loss to not have the underlying name called away.

BMEZ Annual Report (BlackRock)

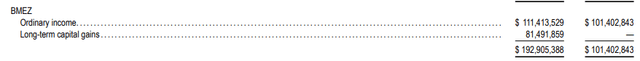

For tax purposes, despite the lack of income generated from the fund, it gets taxed primarily at ordinary income rates. At least for the last two years. I would suspect that over the longer term, we will see long-term capital gains as the primary tax characterization of the distribution. We are also likely to see return of capital this year or next due to the losses that could be being realized through this year. We will get a better idea of this with the next Semi-Annual Report.

BMEZ Annual Report (BlackRock)

The reason we see it classified as ordinary income would seemingly come from short-term capital gains that are lumped in with ordinary income.

BMEZ's Portfolio

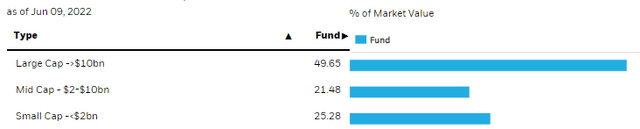

BMEZ is similar to BSTZ and BIGZ because they have a sleeve of private investments. They target up to 25% in private securities. However, they aren't limited to any specific geography or market cap. This fund favors U.S. investments, with its ~76% allocation in U.S.-based names. With private investments generally being smaller companies, we see some exposure to small and mid-cap names.

BMEZ Market Cap Weighting (BlackRock)

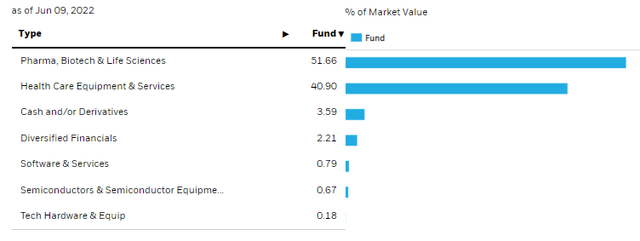

Where they are restricted or focused, though, is the healthcare space. When looking at the industry exposure, we see an overwhelming allocation to the top two healthcare-related spaces.

BMEZ Industry Weighting (BlackRock)

The weightings here don't change drastically. Since the last time we looked at the fund towards the end of January 2022, there haven't been any meaningful shifts.

In their private investments, biotech companies were the majority of these deals.

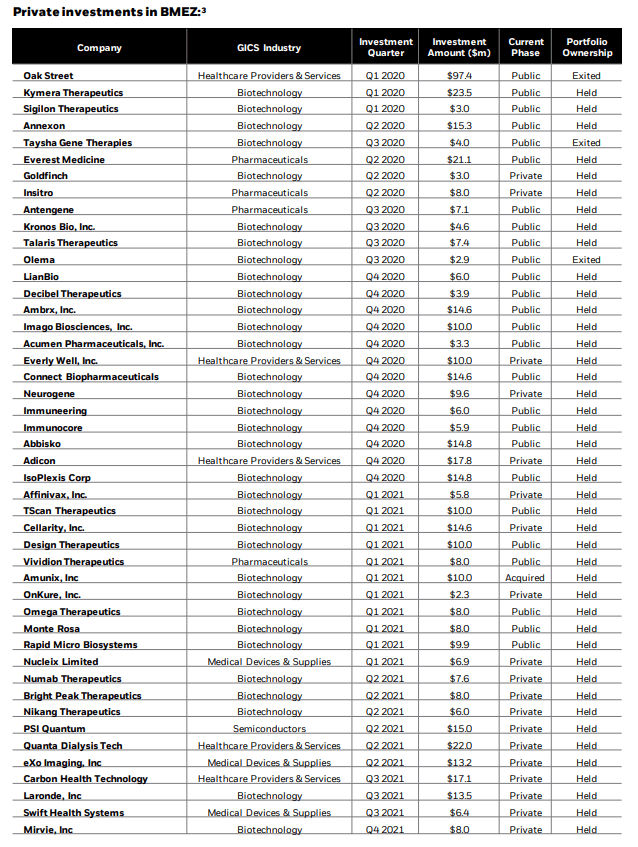

BMEZ Private Holdings (BlackRock)

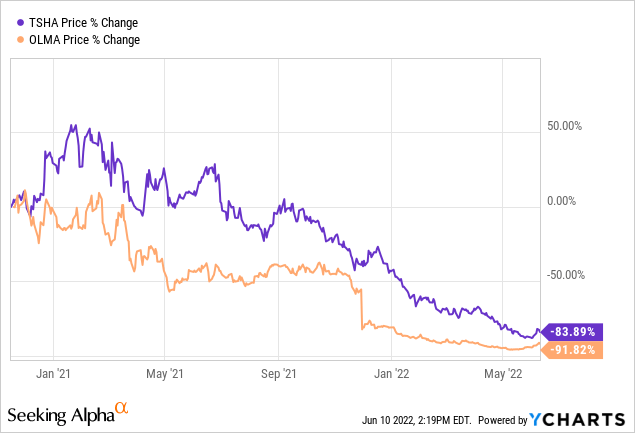

We can see that they have exited only three of these positions, all three of which have become publicly traded during the time they've held them. That would be Oak Street (OSH), Taysha Gene Therapies (TSHA) and Olema (OLMA). TSHA and OLMA being biotech companies, can really highlight just how much of a thrashing this space has received.

They are down to penny stock territory with a $4.01 price on OLMA and TSHA at $3.32.

Ycharts

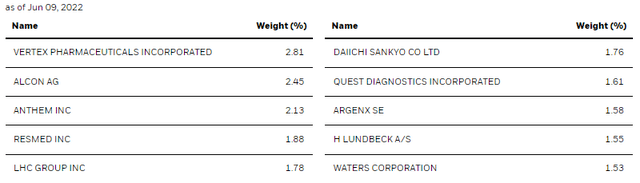

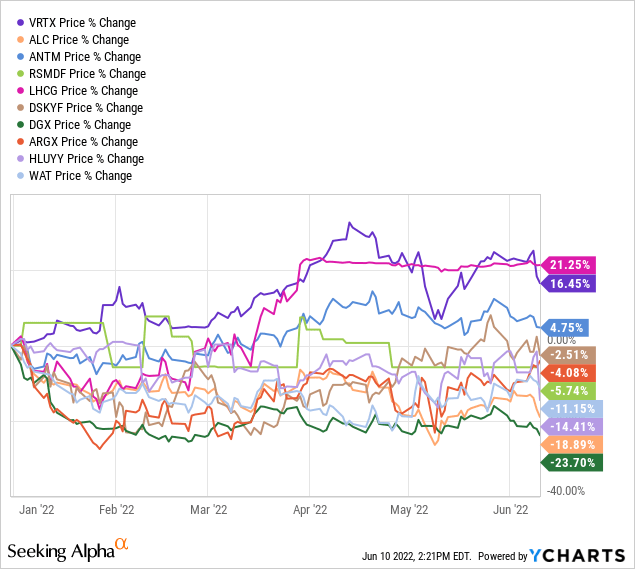

The current top ten names are showing a bit more promise, even though some of these are biotech names too.

BMEZ Top Ten (BlackRock)

They are all publicly traded, too. This is interesting when you consider that BSTZ has a handful of its largest holdings as the private positions.

Ycharts

Quest Diagnostics (DGX) is performing the worst of this group of names. They are a healthcare services stock that provides diagnostic information and services - as the name would suggest.

Conclusion

Personally, nothing in this portfolio is anything I'd hold individual or even generally run across in my normal investing process. That's part of why I am comfortable with my BMEZ position to add diversification to my portfolio. While growth is out of favor, I don't mind being patient for an eventual rebound. The distribution is likely in danger at current levels unless we see a quick turnaround. However, it is expected to pay something at least while waiting. The latest discount and selloff, I believe, are making this a more attractive holding overall and worth adding to at this time. That is, if one is comfortable with exposure to a riskier area of the market.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

waltonleopessenow.blogspot.com

Source: https://seekingalpha.com/article/4518004-bmez-cef-attractive-discount-in-this-beaten-down-name

0 Response to "The Bleatings Will Continue Until Morale Improves"

Post a Comment